New Build Single Family Home Growth

We have seen phenomenal growth and a rebound in new single-family homes since the crisis.

A rebound from the crisis isn’t a surprise, nor is the high growth rate given the easy money environment we have seen and the recovering economy, even during the Covid period.

However, shouldn’t the rate tightening and recent job cuts across multiple industries make people less reluctant to move?

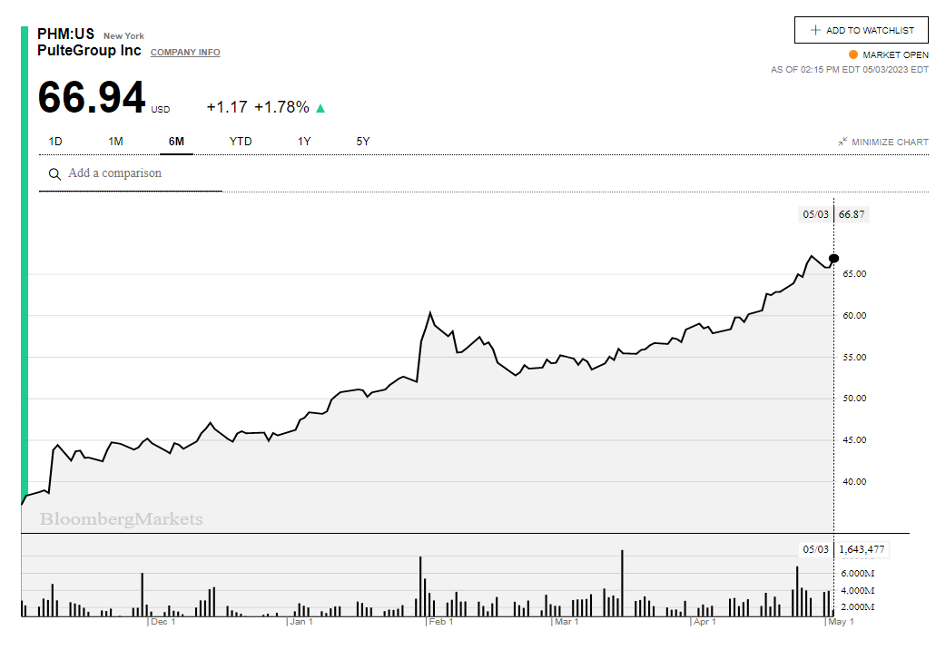

This type of chart (most of the builders) seems unsustainable:

Residential spending should come off dramatically due to lower wages, inflation, higher tax burdens and the psychological effects of these factors hitting buyers. After tax, after necessity pay is going to decline dramatically.

Separately, when looking at both Residential and Nonresidential, there are a couple of expected outcomes given our current environment.

Non-residential should (will) take a beating as lending dries up from the small local and regional banks having to slow down lending. Builders are going to have a reset on expectations in late 23 or in 2024 for sure when their loans rollover. Buyers are going to be more aware of the factors above.

The nonresidential side is going to get hurt not only from the same points but also an expansion in cap rates and continued structural changes in the usage of nonresidential properties.